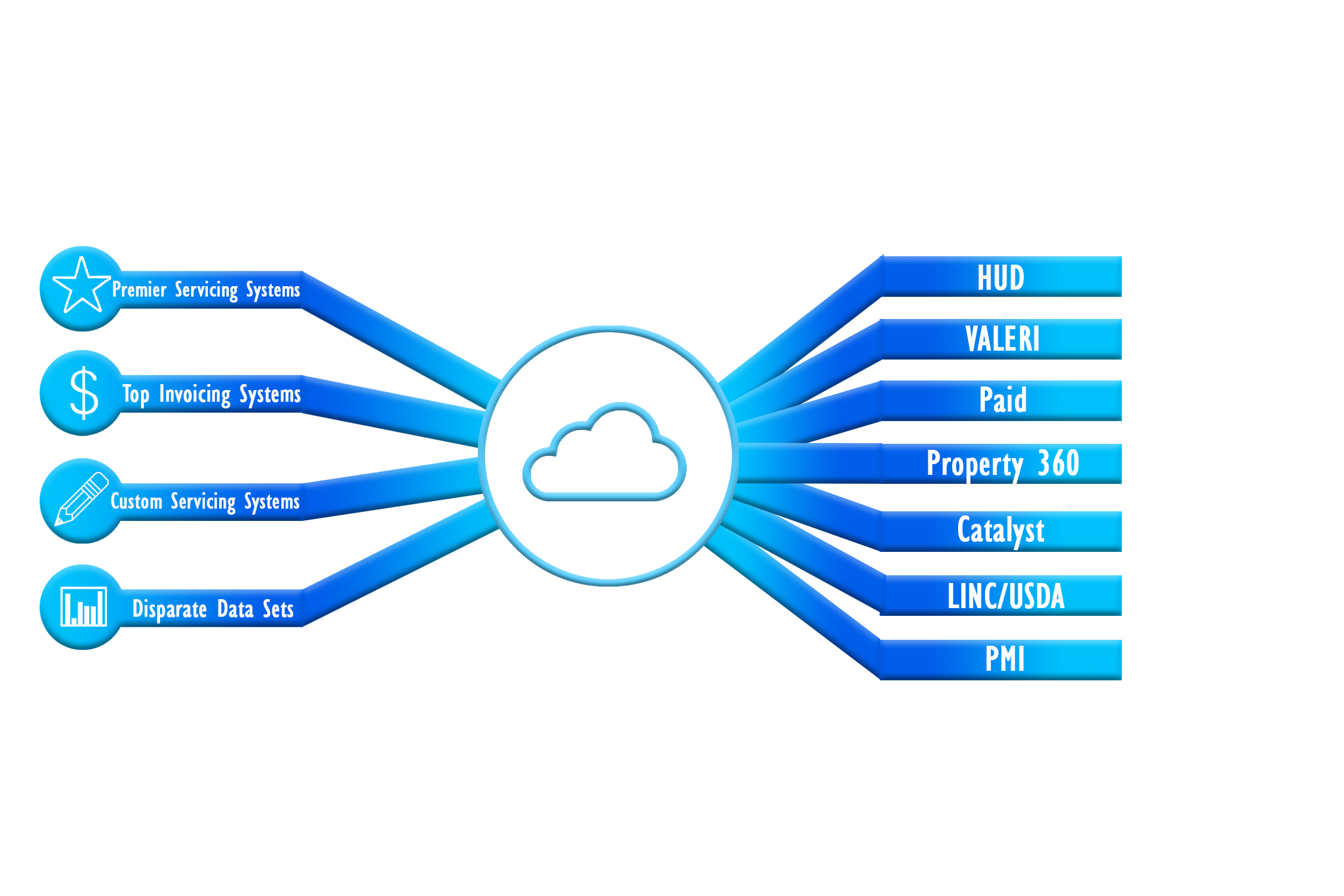

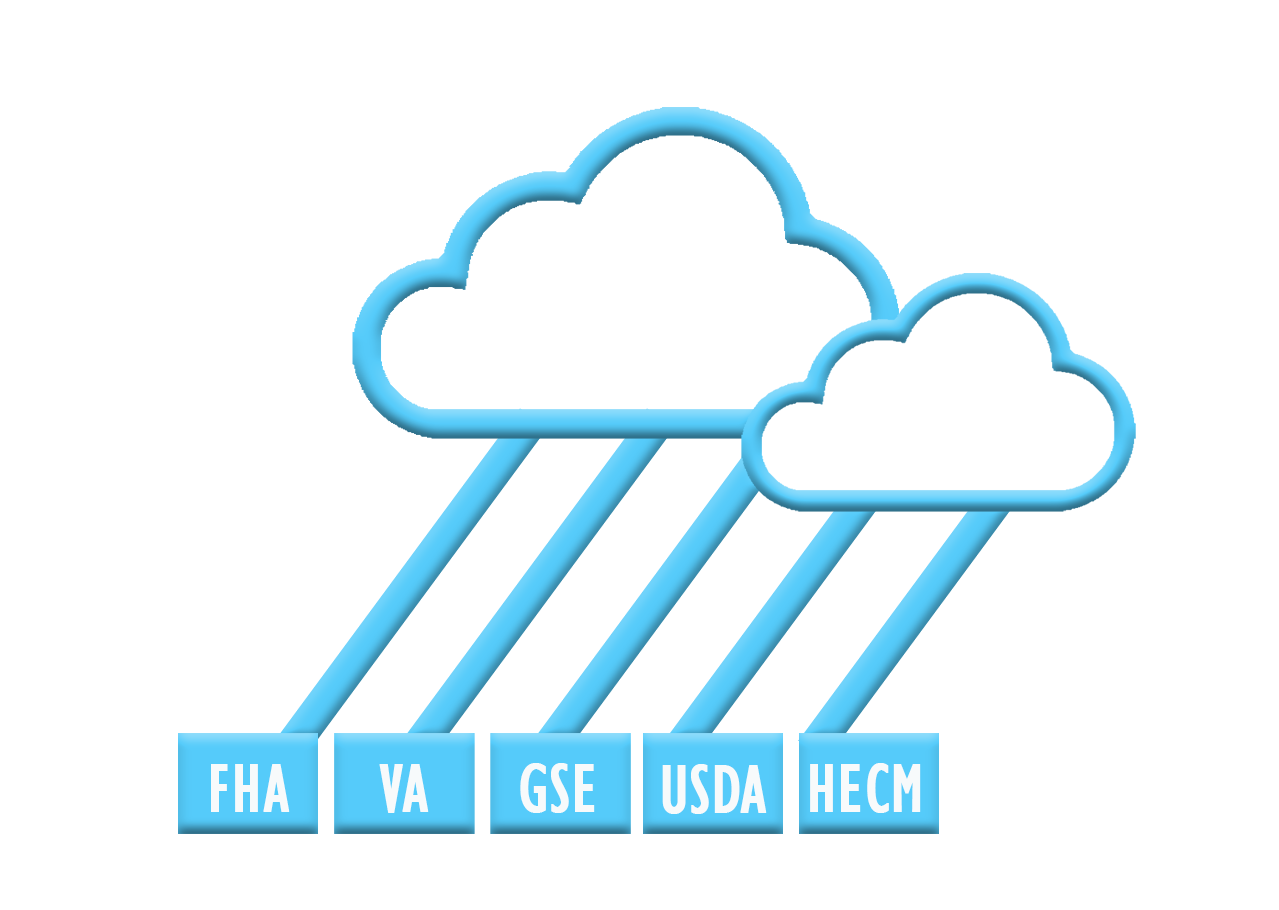

VAT Mortage Services (VAT-MS) provides an array of technology products designed for late-stage default solutions. VAT-MS blends comprehensive rules-based technology, workflow, and reporting in one package to meet the demands of any mortgage servicer.